Cloud-based flood risk learning tool engages multiple stakeholders

A pilot cloud-based learning platform that brings together multiple datasets, models and visualisation tools has been developed with the engagement of numerous stakeholders throughout the design process. This tool could lead to informed decisions about flood risk at the local level. These types of tools and frameworks are effective ways of facilitating better decision making.

Cloud contact centres

BT Cloud Contact Offers customers a complete contact center solution including in built omni-channel, embedded IVR, and an inbuilt customer relationship system as standard.

Cloud of clouds: a global vision for cloud services integration

Our global customers are looking at the cloud to more effectively meet their toughest business challenges. Yet something is stopping them from making the most of what cloud can deliver

Cloud technologies got the maximum investment from Indian firms in last 2 years: EY survey

Sixty-four per cent of organizations in India and Europe invested in cloud technologies in the last two years, followed by IoT, where 51% firms made investments.

CloudMD Is My TeleHealth Stock

Source: Keith Schaefer for Streetwise Reports 04/28/2020

With telehealth becoming a rising star in the coronavirus era, Keith Schaefer discusses why one company rapidly expanding in Canada stands out.An entirely newand highly profitableindustry is being borne out in 2020TeleHealth.

CloudMD Software & Services Inc. (DOC:CSE; DOCRF:OTCQB; 6PH:FSE) is my favorite way to play teleHealth. It's growing quickly with over 100,000 patients registered on its app and over 3000 doctors in 8 provinces in its Electronic Medical RecordsEMRsystem. It has MULTIPLE revenue streams and it just moved into Canada's largest marketOntariosetting up an even faster growth rate.

The recent spread of coronavirus is only accelerating this. COVID-19 has forever changed how we all will think about visiting a hospital or seeing our doctor. We really don't want to do that at all, if possible. It will have a very positive and long lasting impact on teleHealth.

teleHealth companies in Canada are getting paid more money for services than bricks-and-mortar clinics, and have a fraction of the costs. Doctors want more of it, patients want more of it, government wants more of itand the Market REALLY wants more of it. Everybody wins here; there is no downside.

The rapid scale-up and profitability is key for investors.

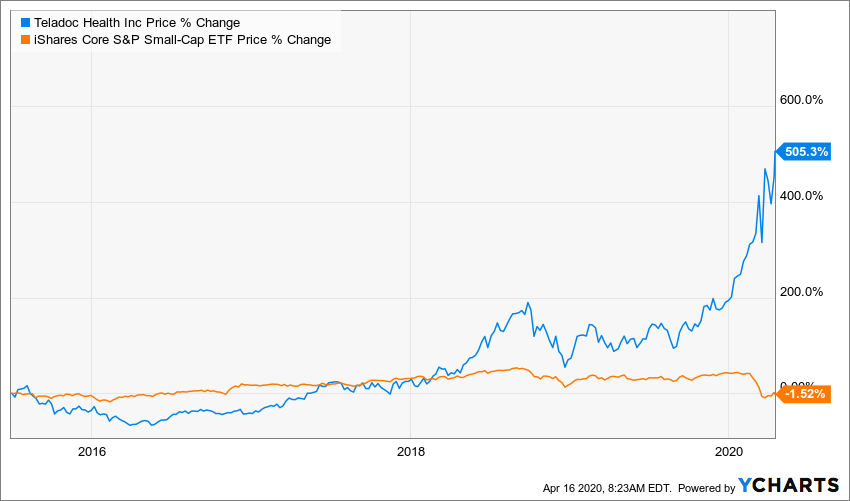

The stock market is now recognizing this trendin spades. You can see it in the stock chart of the U.S. leader in teleHealth, Teladoc Health Inc. (TDOC:NYSE).

While the market plummeted Teladoc's business and share price soared.

Now that a firm trend is in placeand teleHealth is one that makes a lot of senseI'm looking for the junior with the best leverage to this new long term trade.

CloudMD is established, growing quickly and trading at a fraction of its peers.

The average multiple of competitors in the sector trade at 5-7x revenue, and CloudMD is trading way below that at 2.5x per revenue. I'll have more on those comps in a moment.

But realize that the Canadian use of telemedicine is still just a fraction of where it is in the U.Sso the quick, early upside is even bigger.

Literally the Canadian Version of Teladoc Health

The story with this stock is very simple. CloudMD is literally the Canadian version of Teladoc Healthjust at an earlier stage in the growth curve.

The market desperately wants to own teleHealth right now (see also the stock charts of LVGO-NASD and CATS-NASD). I see CloudMD as the best way to do that in the junior sector (where the leverage is!).

For this stock to have a major run all that needs to happen is for institutional investors to wake up to the fact that the company exists. That's happening now with the company entering the province of Ontariowhich has 14.5 million people, over one-third of Canada's population.

CloudMD is a fully integrated health care companykind of like a hospital-in-the-sky. They do have five bricks-and-mortar clinics, but they also own their own EMRElectronic Medical Recordssystem that operates in eight provinces and is used by over 3,000 doctors and is supported by an in-house 25 person development team. They have their own CloudMD appwhich has over 100,000 registered patients already.

Folks, we really are in front of the institutions on this one. I don't have room in this article to even talk to you about the depth and credibility of CEO Dr. Essam Hamza, but after several conversations with him I can say that shareholders are in very good hands.

The EMR gives CloudMD a recurring monthly revenue stream, which The Street loves. The app gives them high margin fees from doctors, specialists and groups like massage therapists and counselors. These people are revenue, not costs. As I said, full hospital-in-the-sky. Multiple revenue sources with lower costs.

To schedule a virtual doctor's appointment all that a patient has to do is download the free CloudMD app and then arrange an appointment with one of the doctors. There is zero charge for the patient and they can see a doctor very quickly.

CloudMD can scale up the number of patients VERY quicklyand they are.

Every aspect of healthcare that's very fractured and disjointed will now be in the one CloudMD ecosystem.

Everyone wins with this system. Patients, doctors, the medical system, society, even investors. Everyone.

TeleHealth Is MUCH More Profitable Than Clinics

Doctors who have signed up with CloudMD work remotely from home or wherever they are (like their winter home down south). The rapid scale-up potential excites me. CloudMD can add in unlimited number of doctors and patientsso it has a virtually unlimited ability to scale quickly with little incremental cost.

Profit margins are wide and there is no cap on the number of customers that can be handled.

After a patient has an appointment, CloudMD bills the government directly just like every bricks-and-mortar clinic in Canada does. CloudMD records 100% of the revenue and gets to keep 30% of the billing for every patient that is seen through telemedicine, which is actually 10% more than what a bricks-and-mortar clinic receives. That is because the governments are trying to push teleHealth.

The doctor gets the other 70% and doesn't have to deal with any headaches of commuting or running a business.

Without the overhead of a bricks-and-mortar clinic, AND more revenueCloudMD will be much more profitable than traditional health care stocks.

Faster scale, more cash flow. And they just entered Canada's largest market. This is the right stock in the right market at the right time.

When CloudMD goes from one doctor to 10 doctors to 100 doctors working at the same time, they don't have to build more clinics. They don't have to create more rooms for them or hire more staff. They just sign them on. That's it.

And we are not just talking about family doctors. They are also adding specialists and third party services like counseling and physiotherapists to the platformand again, all these people are revenue, not costs.

That's the great thing about this business model. It's very scalable, very easy, and it grows very quickly.

CloudMD has been growing its recurring SAAS (Software-as-a-Service) revenue by 30% YoY with its EMR system. But this year the company is expecting that doctor growth to be much much higherwith a new full time sales team and the coronavirus pandemic. SaaS revenue is highly lucrative!

Consumer growth (patients) using the CloudMD app is growing even faster. And the recent COVID-19 situation will only turbocharge that.

Another Revenue Stream, Another Win-Win

There's another angle herepharmacies. CloudMD says they will partner with more than 150 pharmacies in 2020 alone who are afraid of losing prescription business to Amazon (AMZN-NASD).

Those pharmacies are paying $500 a month for CloudMD kiosks to be in their pharmacieswhere customers can get a prescription from a doctor on demand.

This keeps the customer in the pharmacy for their prescriptionnot out to see a doctor and then off to Costco to get it filled.

Pharmacies that don't see the writing on the wall will become the blockbusters of the industry and get left behind.

With the kiosk in the pharmacy, a person can just see a doctor right away, within 10 minutes, and walk the prescription back to the pharmacist.

Buy-outs Are Happening at High Valuations

We know that these businesses are worth.

Grocery giant Loblaws purchased QHRanother Canadian based EMR companyfor $3.10/share or 7.5X revenue. Note that QHR's former Chairman Mark Kohler recently joined CloudMD's Board of Directors.

Teladoc bought a company out of Quebec just two months ago called InTouch for about US$600 million, which again is about 7.5X revenue. Teladoc itself trades at more than 10X revenue.

CloudMD trades at 2.5X revenue, less than a third of recent transactions. Meanwhile the company is poised to grow revenues at a high double digit rate for the foreseeable future.

TeleHealth is the future of how our healthcare is delivered.

Everyone has always expected that the growth would be just like what Netflix experienced with streaming, shaped like a hockey stick. The hockey stick shape is slow at the start as early adopters move and then straight up as the mainstream catches up with plot.

The demand for teleHealth from COVID-19 just took the flat part of that hockey stick out of the equation and instead took the industry directly to the exponential growth curve.

The jumping off point for teleHealth is here and I think CloudMD is the best pure-play teleHealth stock right now.

TeleHealth is to healthcare what streaming was to video rentals, and what Amazon was to retail. IT IS THE FUTURE.

Now is the time for investors to get on board, especially in Canada where virtual healthcare only accounts for 0.15% of the market and the growth curve will be much steeper.

And for me, that's CloudMD. It's the new normal. I'm long.

Keith Schaefer is editor and publisher of the Oil & Gas Investments Bulletin. He has a degree in journalism and has worked for several Canadian dailies but has spent over 15 years assisting public resource companies in raising exploration and expansion capital.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-newsDisclosure:

1) Keith Schaefer: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: CloudMD. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: CloudMD. My company has a financial relationship with the following companies mentioned in this article: None. Additional disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with CloudMD. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of CloudMD, a company mentioned in this article.

Keith Schaefer Disclosures:

CloudMD has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.

Keith Schaefer is not registered with the United States Securities and Exchange Commission (the "SEC"): as a "broker-dealer" under the Exchange Act, as an "investment adviser" under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

Charts provided by the author.

Clouded leopards, from crisis to success: Q&A with Janine Brown

The clouded leopard, a native of Southeast Asia, is among the most charismatic, secretive and least understood cat species in the world. In 2002, the […]

The post Clouded leopards, from crisis to success: Q&A with Janine Brown appeared first on Smithsonian Insider.

Clouded leopard cubs born at Smithsonian Conservation Biology Institute

Sita (SEE-ta), a 2-year-old female clouded leopard at the Smithsonian Conservation Biology Institute in Front Royal, Va., gave birth to these two cubs on Monday, […]

The post Clouded leopard cubs born at Smithsonian Conservation Biology Institute appeared first on Smithsonian Insider.

Clouded leopard cubs born at National Zoo’s Front Royal campus on Valentine’s Day

Staff had been on a pregnancy watch focused on the 3 1/2-year-old clouded leopard Jao Chu (JOW-chew) for four days. Jao Chu gave birth to the first cub at 6:04 p.m. and the second cub at 6:20 p.m.

The post Clouded leopard cubs born at National Zoo’s Front Royal campus on Valentine’s Day appeared first on Smithsonian Insider.

Webinar: What we think about global warming?

Cloudy head on climate change? Join the webinar on Wednesday 30 March 2016 from 1-2 pm (Paris time) with Professor Per Espen Stoknes on What we think about... when we try not to think about... global warming!

Cloud Computing: The Concept, Impacts and the Role of Government Policy

Cloud computing has become a platform for innovation. This paper looks at how the cloud changes the way computing is carried out, and evaluates the benefits, challenges and economic and environmental impacts. It discusses the policy issues raised and the role of governments and other stakeholders in addressing them.

cloud-sailing: Santiago, Chile by So Cal Metro on...

Santiago, Chile by So Cal Metro on Flickr.

Check out travel recommendations at Wanderfly!